Business Insurance in and around Erie

Looking for small business insurance coverage?

Helping insure small businesses since 1935

Help Protect Your Business With State Farm.

Preparation is key for when a problem happens on your business's property like an employee getting hurt.

Looking for small business insurance coverage?

Helping insure small businesses since 1935

Protect Your Future With State Farm

With options like errors and omissions liability, extra liability, worker's compensation for your employees, and more, having quality insurance can help you and your small business be prepared. State Farm agent Jeremy Borrero is here to help you customize your policy and can assist you in submitting a claim when the unexpected does arise.

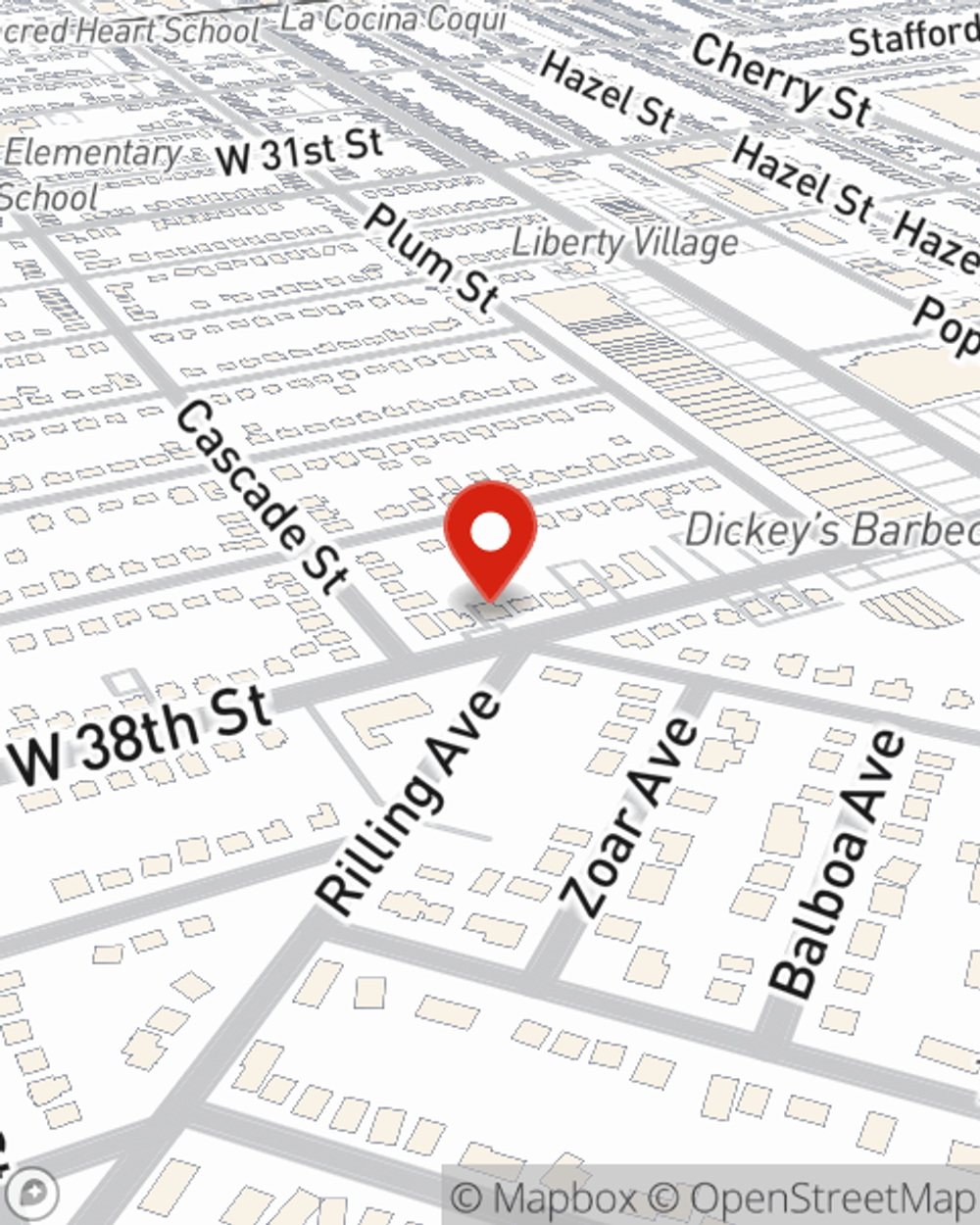

Ready to discover the specific options that may be right for you and your small business? Simply contact State Farm agent Jeremy Borrero today!

Simple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Jeremy Borrero

State Farm® Insurance AgentSimple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.